The rise of the super app: 6 things fintechs can do to become more ‘super’

In a nutshell

- Super apps offer a full range of services integrated into a single app, from finance- to payment-related services.

- Following the success of super apps in Asia, fintechs in Europe are starting to integrate non-financial services to become more ‘super’.

- Companies need to advance a super app strategy now or risk being left behind.

That’s at least according to a panel of experts that discussed the rising super app trend during a webinar with Qover.

Balázs Gáti from UK fintech Revolut, Louisa Murray from embedded finance platform Railsbank and financial super app expert Simon Torrance shared insights about where the trend is heading, how it will affect financial services companies and what fintechs should already be doing to capitalise on the next big thing.

Watch the full replay of the conversation here →

What is a super app?

All-in-one platforms, super apps offer a full range of services integrated into a single app, from finance- to payment-related services.

‘Those who run super apps operate a type of platform business model, which means they’re orchestrating a whole load of services to help customers go through their everyday lives,’ says Simon Torrance, Founder & CEO of Embedded Finance & Super App Strategies. ‘It’s a very sticky, attractive destination for both consumers and merchants.’

Rather than redirecting people to a bunch of different websites or apps, says Louisa Murray, COO of UK and Europe at Railsbank, ‘It’s about creating [one] seamless, transparent user experience.’

What does the future of super apps look like in the European fintech space?

Well-known super apps like Alipay and WeChat have taken off in China. Balázs Gáti, Global Head of Insurance at Revolut, says that market conditions and competition have made the European sphere much more scattered.

Now, Western companies are looking for the right angle to build out a super app. Players like Uber and Bolt are approaching it from a mobility angle, while Revolut is entering from a financial services point of view.

‘There’s enormous potential,’ Louisa says. ‘I don’t think we’ve even seen the tip of the iceberg.’

Balázs believes that there will be a rise in competing super apps before they eventually consolidate into a handful of successful players, similar to big tech. He also sees the boundary between financial and non-financial services diminishing over time.

‘I think there will be more and more financial platforms or super apps that will start to integrate non-financial services,’ Balázs says. ‘Revolut introduced an ecommerce proposition, while non-financial platforms like Uber and Bolt are integrating more embedded service products around account management, credit and insurance.’

So who will win in the end?

‘The ultimate race will be determined by whether you can continuously serve your customer base with innovation and ensure that the customer experience remains as good as when you started out,’ Balázs says. ‘I think that’s the biggest challenge we face in the industry.’

According to Simon, ‘Those who are best at orchestrating ecosystems will win. They could be incumbents that already have large customer bases and good assets or they could be completely new companies like Revolut.’

Ultimately, it’s about thinking beyond the normal boundaries and understanding how technology can serve customers in completely new ways.

.webp)

How to build a super app?

1. Clearly define your ambition

To become more ‘super’, as Simon put it, companies should clearly define a goal that the whole organisation can get behind.

Both Simon and Louisa stressed the need for company leadership to be ambitious about innovation and have a desire to better engage their customers.

‘If you don’t have internal stakeholders – when no one recognises what is possible, or wants to recognise it – it’s going to be very tricky,’ Louisa says.

Balázs shared an example from Revolut's core values about never settling: ‘We adopted this quote around 10x growth and improvement. I think it’s a very important mindset when it comes to product improvement, growth ambitions and motivating your people – you need to convey that that’s possible. If people share that joint ambition, then they can actually achieve 10x [more].’

2. Hire a talented team

Once you have a clear goal and company buy-in, it’s important to hire – and scale – accordingly.

‘Tech is built by people,’ Balázs says. ‘What you can’t compromise on is talent. When it comes to your engineers, data scientists, product owners, etc., you need to be able to attract and retain the best and brightest.’

‘You need to keep people motivated – that what they’re building is exciting, revolutionary and really at the forefront of evolving industries,’ he says. ‘You need to sell that vision and get buy-in from your people.’

3. Continue to innovate

The message for fintechs in an ever-evolving landscape? Keep up or risk being left behind.

‘You need to continuously innovate and bring new propositions to your customers,’ Balázs says. ‘You bring one proposition to the market and the next day there will be another competitor that comes with an even more innovative one.’

With crypto, for example, you might start with one easy-to-use feature, but face more competition over time.

‘We [then] need to see what additional features our users are eager to use in the crypto world. You need to constantly work on reducing or closing the gap to any competitor that comes out with innovation,’ he says.

4. Layer services to offer a wider product selection

Growing your user base is crucial, the experts say, but retention comes from providing more value through additional products.

Adding different levels of service to an already loyal user base could be a ‘golden opportunity’ for super apps in the making, Simon argues.

Once your customers regularly interact with you and trust you, you can offer a wider selection of relevant products. ‘Then you can be more valuable to them and generate more customer lifetime value – and the acquisition costs are quite low,’ Simon says.

To build out such a financial services ecosystem, it’s important to find strategic partners who can help put those value propositions into place. ‘The key principle of a super app and a platform business model is that you, as the brand or company, don’t have to create these products yourself,’ Simon adds.

So any company with a customer base can essentially act as an intermediary between what their users need and third-party providers who have solutions. ‘That’s the essence of a super app,’ Simon says. ‘The more choice and selection you can provide, the more sticky and attractive it is for end users and merchants.’

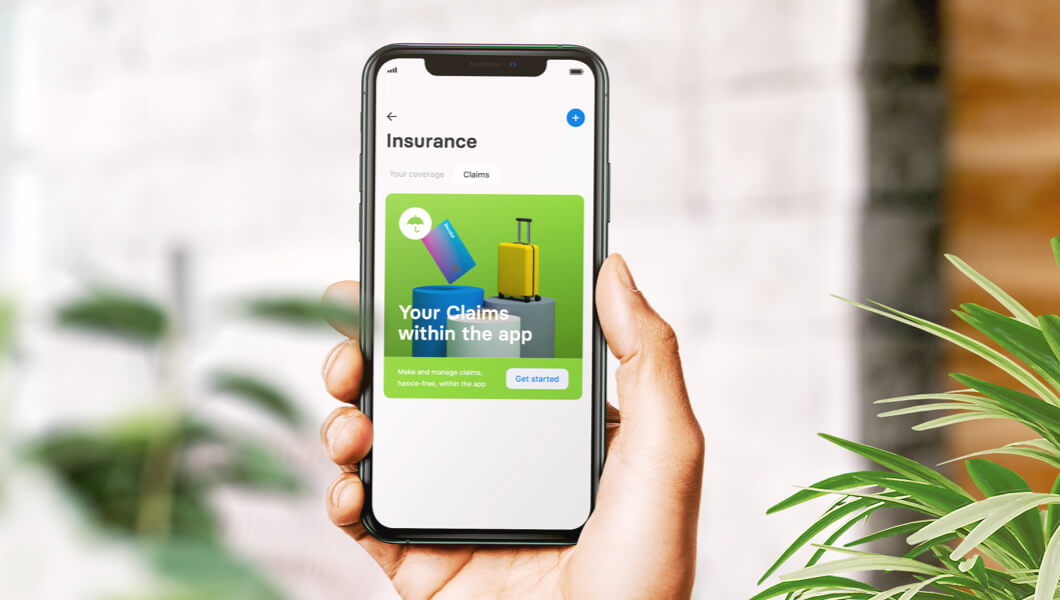

Balázs adds that platforms always start with a ‘hook product’, or something that users become familiar with before introducing them to additional services. Since Revolut’s initial card offering, they’ve added features around stock, crypto, e-commerce and insurance.

‘When it comes to super apps, the reason you’re trying to combine high-frequency services and layer them on top of each other is to make sure you have valuable daily interactions,’ Balázs says.

‘The beauty of Revolut is that the acquisition engine doesn’t have to be insurance – it can and should be – but it doesn’t necessarily have to be,’ he adds.

‘Because you have all of those different engines to bring in additional customers – that you then get to know and understand their needs – [you can] reach out with the right proposition at the right time through the right channel. This is how it becomes a long-term competitive edge.’

See how embedded insurance helps Revolut customers in their daily lives →

5. Make it social

More and more platforms are integrating a social network or entertainment aspect as a way to increase user engagement, which the experts say speaks to our human desire for community and connection.

‘Everyone wants to be part of a tribe, whether it’s traders or gamers,’ Louisa says. ‘I think it’s an excellent part of getting people to use the platform and app.’

‘The social aspect is very important,’ Balázs says. ‘[Our product] Revolut Junior allows parents to teach their kids the basics of finance. You have messaging features using the app’s P2P functions, you can send gifts – which is surprisingly popular – and then you have a feature where you can send money to charity through the platform.’

‘All of these elements build and strengthen the community around the service you're offering, which is key if you want to remain relevant to your customers.’

6. Think globally

In order to achieve market dominance in the long-term, it’s more important than ever for fintechs to scale.

‘You’ve got to be global, whether you’re a fintech or [any other] brand,’ Louisa says. ‘With fintechs, it takes a little while. They’ve got to grow their customer base and scale in one country, then move on quickly – some move quicker than others, such as Revolut – but ultimately it takes a bit of time.’

Balázs agrees, highlighting Revolut’s ‘progressive expansion strategy’ that spans from the US to Japan.

But he also points out that getting the right product market fit is tremendously important as you scale. ‘A product or value proposition that works really well in one part of the world won’t work in another,’ he says. ‘So you need to think about how to adapt the value proposition and enhance it before you make those moves across the globe.’

To become a super app, fintechs have to start somewhere

Becoming a super app doesn’t happen overnight. But the important thing is to start preparing and innovating now.

‘I would recommend that those with experience and a customer base roll things out, whether by country or product,’ Louisa says. ‘You’re not going to have everything up and running on day one.’

‘It's always an evolution, right?,’ Balázs added. ‘You need to start with something. Generally the global ambition to be the best in all verticals is ambitious enough – and you can’t pull that off right away. You have to build a team that’s extremely strong and capable of building that tech, maintaining it and constantly innovating. It takes a lot of financial resources to build up. With millions of apps out there, it’s really hard to cut through that noise.’

Simon thinks that the best way to stand out is to think about the ‘noble purpose’ behind things like financial services and insurance.

‘There are huge numbers of people that are underprotected and underserved,’ he says. ‘The movement in embedded finance will allow us to connect the right types of solutions to the right people in a much more efficient way so that we’re able to retire comfortably and be protected without it costing us a fortune.’

‘Those [companies] who think about the societal benefits as well as how they can think beyond the normal boundaries will succeed best in this world.’

At Qover, we help fintechs like Revolut, Monese, Monzo, Qonto and more add value for their customers through embedded insurance.

.png)