Veloretti’s urban cyclists commute in style across the Netherlands, Belgium and Germany. And the company’s first electric bikes are no exception. The state-of-the-art e-bikes – available in two designs: IVY and ACE – are powerful, and maintain the brand’s classic design.

With the launch of these new, more expensive bikes, Veloretti wanted a way to reassure its customers and give them peace of mind if their bike is stolen or damaged.

‘We want to unburden [our] customers,’ said Veloretti COO & CFO Jitse Rupp. ‘Insurance is an important add-on that can help reassure customers when buying an expensive bike. It could be that extra nudge when deciding to buy it!’

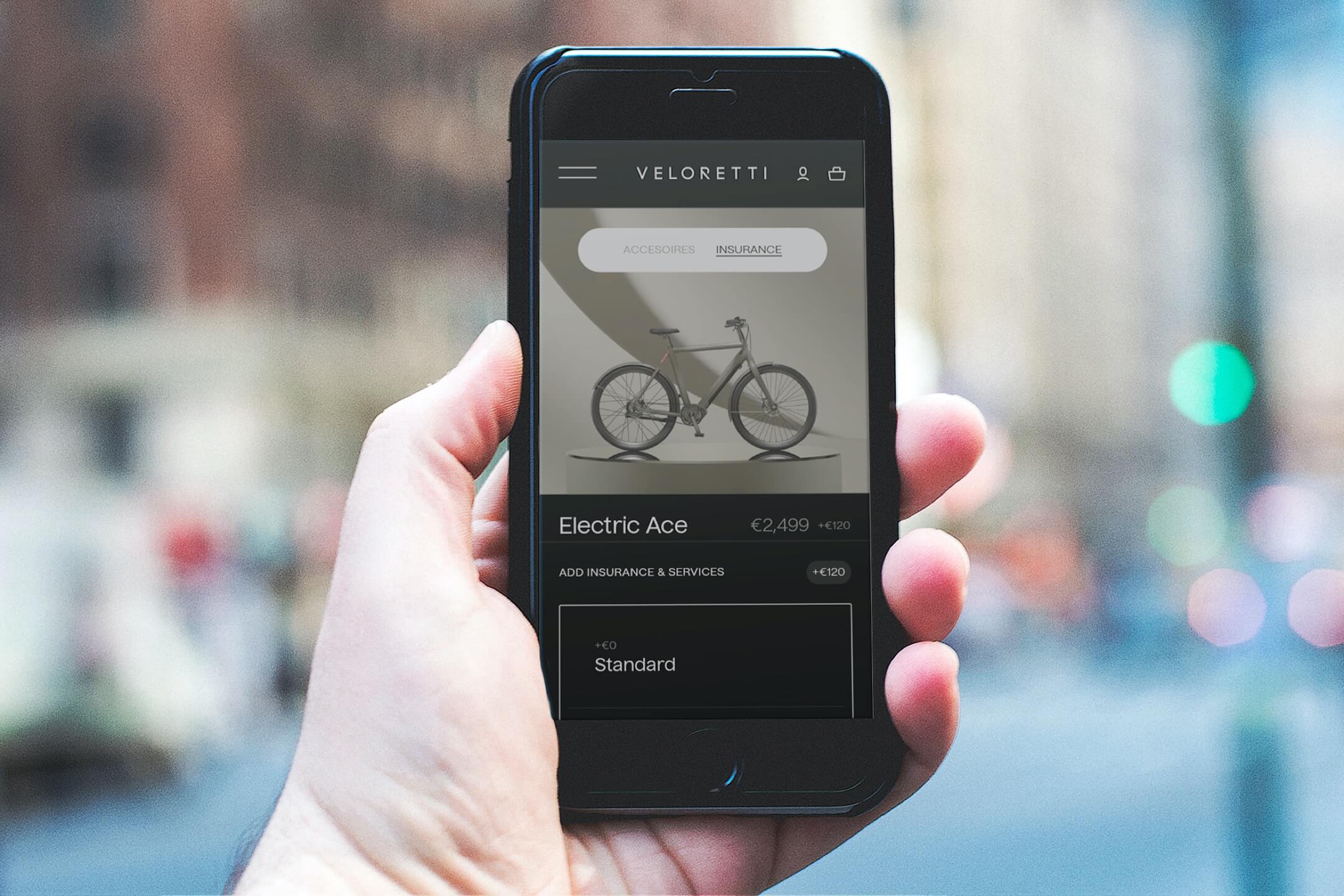

Not only that, but the brand wanted a comprehensive solution that was aligned with its sleek UX, so it needed an embedded insurance product that was completely integrated with its online store.

‘We needed a partner that could offer an all-in-one package to our customers,’ Jitse said. ‘And with whom we could easily integrate everything into our website.’

At Qover, we offered an insurance solution that was hard to pass up: our streamlined insurance during checkout was expected to have a 50% conversion rate – and Veloretti saw it firsthand.

When Veloretti customers check out, they can choose the premium package (including Qover’s insurance) for a one-time payment of €120 (which equals €10 a month). It includes theft and damage coverage as well as roadside assistance in select countries.

‘Making the purchase [process] as smooth as possible certainly helps at checkout,’ Jitse said. ‘With Qover’s flexibility and ambition, they helped us provide the best experience for our customers.’

What’s more, Qover’s e-bike insurance is pan-European and future-proof: as Veloretti expands, we scale with them – ultimately giving their customers, as Jitse puts it, that ‘never-having-to-worry feeling.’